philadelphia wage tax rate

In the state of California the new Wage Tax rate is 38398 percent. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

Philadelphia City Council Approves Business Wage Tax Cuts In 5 6b Budget Deal Nbc10 Philadelphia

For residents of Philadelphia or 344 for non-residents.

. Non-residents who work in Philadelphia must also pay the Wage Tax. The current city wage tax rate is 34481. Starting in 2022 you must complete quarterly returns and payments for this tax electronically on the Philadelphia Tax Center.

The new Wage Tax rate for residents is 38398. The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712. With that household income youd pay 1886 per.

The average income tax rate for counties and large municipalities weighted by total personal income within each jurisdiction is 125. City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021.

The Philadelphia Net Profits Tax NPT which is imposed on the net profits from the operations of a trade business profession enterprise of other activity. Kenney had proposed reducing the. In the state of California the new Wage Tax rate is 38398 percent.

The new City Wage Tax rates are 38907 percent for residents and 34654 percent for nonresidents compared to the current rates of 39004 percent for residents and 34741 percent for nonresidents. 45 percent on transfers to direct descendants and lineal heirs. For detailed and historic tax information please see the Tax Compendium.

On Thursday Philadelphia City Council voted to reduce wage taxes to 379 from 387 for residents and 344 from 345 for non-residents. The new rates are as follows. In addition non-residents who work in Philadelphia are required to pay the Wage Tax.

The July 1 st city wage tax increase will take effect the same week that Philadelphia moves into the green phase for. In 2019 it carried the highest wage tax in the nation. For non-residents the Wage Tax applies to compensation for work or services performed in the City and for work performed outside of the City for personal reasons.

The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481. Philadelphia City Wage Tax Refunds. But for the 2023 fiscal year the City of Philadelphia is reducing that tax rate to the lowest its been in five decades.

Non-residents who work in Philadelphia must also pay the Wage Tax. The new Wage Tax rate for residents of Philadelphia is 39102 039102. 2015 Philadelphia Wage Tax Reduction Philadelphia business owners and those that withhold taxes on employees that live in Philadelphia should take notice that the City of Philadelphia has reduced the City Wage Tax rate effective July 1 2015.

Employees who are nonresidents of Philadelphia and who are required to work at various times outside of Philadelphia within a calendar year may file for a wage tax refund directly with the City of Philadelphia. Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481. Like 14 other states Pennsylvania allows cities and other localities to collect a local income tax in addition to the Pennsylvania Income Tax.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a decrease from the previous rate of 38712. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021.

Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent. The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer. The wage tax rate is set to drop from 384 to 379 for city workers and the median annual household income for Philadelphia is about 49k.

Pennsylvania income tax rate. In addition non-residents who work in Philadelphia are required to pay the Wage Tax. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

Census Bureau Number of municipalities and school districts that have local income taxes. Be certain your payroll systems are updated to reflect the increased non-resident tax rate. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. Inheritance and Estate Tax. The new rates are as follows.

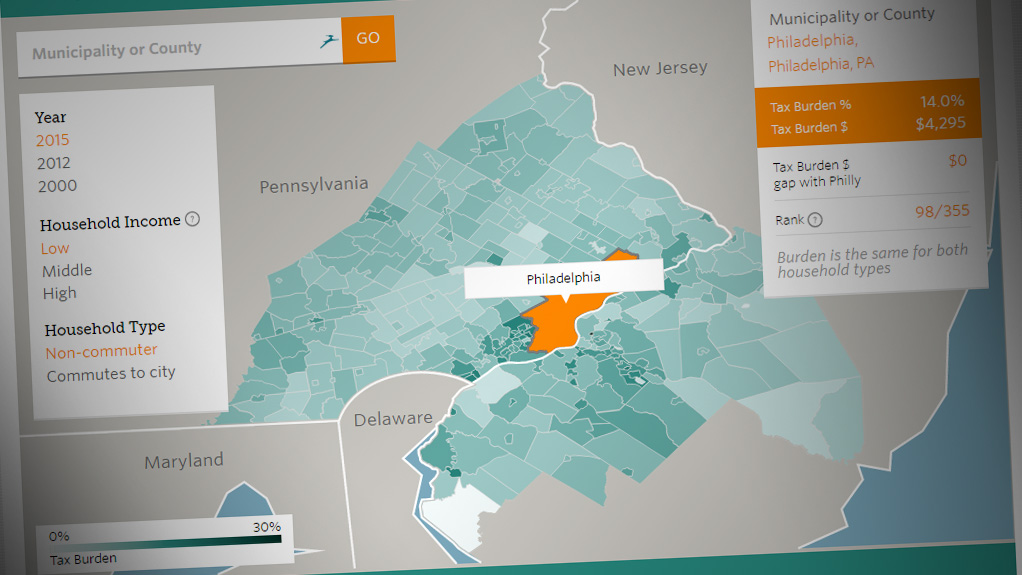

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

Approval Of Business And Wage Tax Cuts Hailed As Turning Point By Philadelphia Business Leaders Philadelphia Business Journal

Philadelphia Is Cutting Taxes Finally It S About Time Opinion

City Announces Wage Tax Reduction Starting July 1 2017 Department Of Revenue News City Of Philadelphia

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Philly Wage Tax To Be Lowered In New City Proposal Whyy

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

Philly City Council Reaches Budget Deal With Tax Relief Whyy

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News